By Albert Allotey

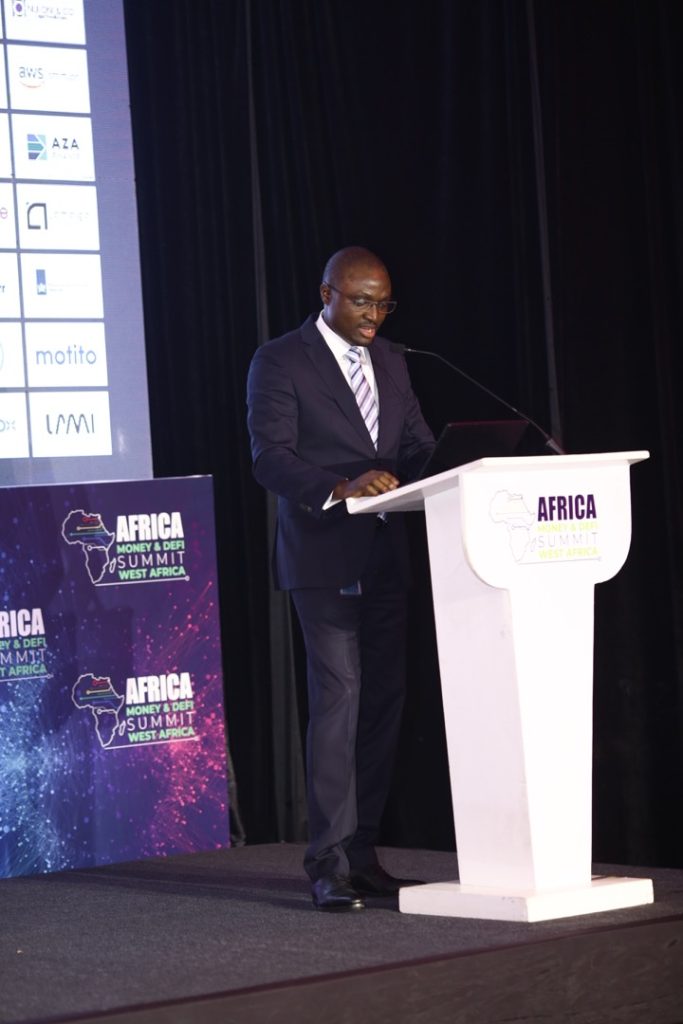

Accra, Sept. 29, GNA – Mr Kwame Oppong, Director of Fintech and Innovation at Bank of Ghana, has called on Fintech and Crypto Industry leaders to be resolute in building safe and resilient space to safeguard the interest of consumers.

He said the enormous opportunity for affordable digital delivery of financial services to enhance financial inclusion had emerged as a new business model product and mode of interaction, posing a significant challenge to governance regulation, consumer protection, and financial integrity.

“For this reason, the Bank of Ghana implemented reforms to enable innovation in the financial services industry without compromising financial stability of which the Payment and Services Act of 2019 is at the care.”

Mr Oppong made the call when he addressed about 400 Fintech and Crypto Industry leaders from across Africa at a two-day Africa Money and Decentralised Finance (DeFi) Summit – West Africa edition in Accra.

He noted that Act 987 and other related notices issued by the Bank of Ghana had non-traditional entities such as Fintech to be licensed to provide various digital financial services under a proportionate and risk-based licensing regime.

“The elevations of these team players are positively disrupting the financial services industry and generating competition while encouraging strategic partnerships among these banks and financial technology providers,” he stated.

Mr Oppong said immense benefits had been reaped from using the regulatory environment provided by the Bank of Ghana, resulting in phenomenal increases in financial inclusion from 58 per cent in 2017 to 68 per cent in 2021 and that this was noteworthy.

He said since the Fintech Innovation Office was established in 2020 at the Bank of Ghana, which was one of the few such outfits globally among central banks to regulate and supervise, a total of 47 payment service providers and mobile money operators, both Ghanaians and foreign, were approved across various licensing categories to provide payment services.

“The interest of the investors both local and international continue to increase on the account of the favourable regulatory regime and the abundance of opportunities. Similarly, the bank is noted for its open-door policy and constructive engagement with industry stakeholders, prospective service providers and innovators.”

The Director said a considerable resources have been invested in studying and monitoring development in virtual assets and similar products including decentralized finance applications, non-fund road tokens, among others.

“The Ghanaian ecosystem is still an upcoming frontier market and therefore it takes these studies and findings seriously. Our regulatory stance is in line with our mandate to ensure financial stability of which consumer protection and financial integrity are essential component,” he stated.

Mr Oppong said: “To this end, the Bank of Ghana would continue to monitor development and implement measures to forestall any risk in the ecosystem in collaboration with other regulators and stakeholders where necessary.

“Any regulation issued will be in line with our quest to promote safe, sustainable and inclusive innovation that kindle the confidence in the ecosystem, and I must emphasise that consumer trust is of utmost importance to any financial service industry and in this case a key ingredient to achiving our financial inclusion goals.”

Mr Andrew Fassnidge, Founder Africa Tech Summit Kigali and London, said the purpose of the summit was to discuss and connect people to do business and was attended by key stakeholders like startup ventures, banking regulators and investors.

The expectation was to see the growth of crypto across Africa and a new wave of DeFi to drive business and investment.

The Africa Money and Summit West Africa is a leading African fintech, decetralised finance, mobile money and crypto event brought by curators of Africa Tech Summit series and provides insight and networking within the Pan-African Fintech, DeFi and Crypto ecosystem.

GNA