By James Amoh Junior

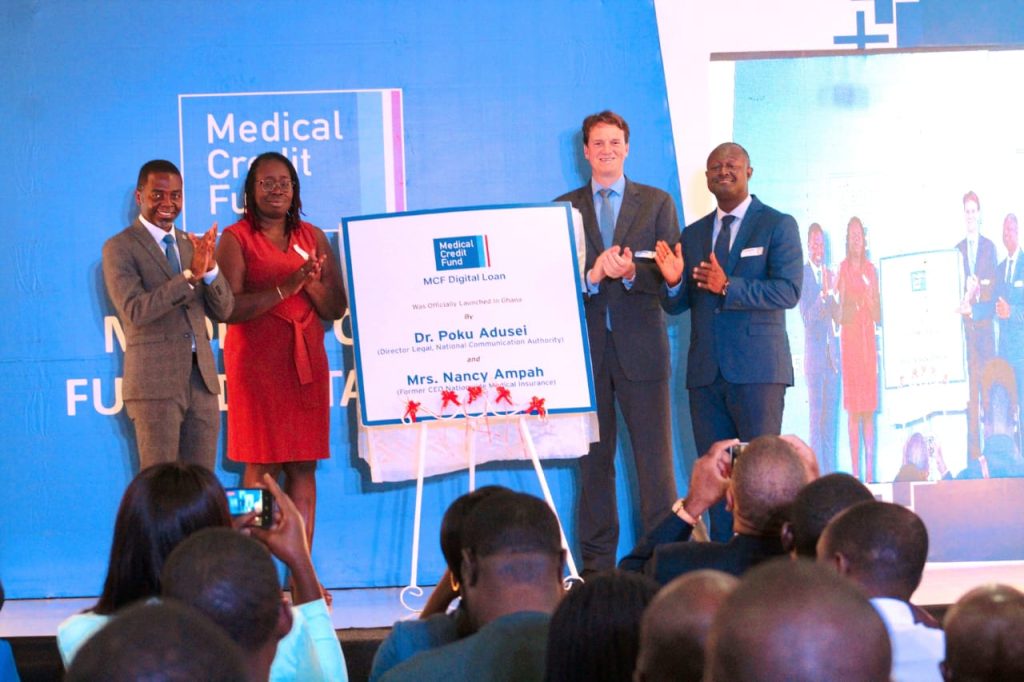

Accra, Sept. 28, GNA – The Medical Credit Fund (MCF), a provider of financial solutions for healthcare providers in sub-Saharan Africa, has launched an innovative Digital Loan product in Ghana, making healthcare financing more accessible.

The Medical Credit Fund, established in 2009 as part of PharmAccess, an international development organisation, is a non-for-profit fund exclusively dedicated to financing small and medium-sized healthcare enterprises in Africa.

In line with Sustainable Development Goal Three on good health and wellbeing, MCF seeks to increase access to quality health care while utilising innovative financing solutions and digital technologies assistance to expand health businesses.

Following the success of the MCF Digital Loan in Kenya, where more than 6,000 MCF digital loans were disbursed, MCF is currently expanding its footprints and bringing accessible and affordable healthcare financing to healthcare providers in Ghana.

Dr Poku Adusei, the Director Legal, National Communication Authority (NCA), who launched the digital initiative, said the execution of the fund dovetailed suitably with the digitisation and digitalisation agenda of the Government, ensuring that the Fund provided business loans to healthcare businesses.

The Government through the Ministry of Communication, Dr Adusei said, was playing a pivotal role, providing an ecosystem to support the digitisation of the Ghanaian economy in ways that captured and benefited every citizen.

“It is laudable with the health sector embracing the Government’s digital agenda. It is our ambition as the National Communication Authority to push the agenda forward. With a product of this nature, in the long term it will be replicated elsewhere to boost the Ghanaian economy”.

He said as a doctoral student at McGill Canada, he researched into the subject of “Patenting of Pharmaceutical and Development in Sub-Saharan Africa: Law, Institutions, Practice and Politics” which uncovered “a wide gulf in the financing of healthcare and medical research in the global west and in the global south.”

He discovered that 90 per cent of global financing of healthcare and research was dedicated to western diseases while the remaining 10 per cent went into tropical diseases in the global south.

Thus, he said, the financing disparities in healthcare were concerning, and that the MCF digital loan product was significant for the healthcare delivery ecosystem.

Mr Joseph Hansen-Addy, MCF Director, Ghana, said the initiative was a quest to ensure quality and better health care as hospitals, clinics, diagnostic centres, laboratories, medical equipment vendors, pharmaceutical retailers, wholesalers, health training institutions were challenged in obtaining finances to ensure optimal operation.

“We are keen to ensure that there are funds to ensure that there is quality and better health care in the country, hence the collateral-free digital loans,” he said.

Mr Hansen-Addy called on health Small and Medium Enterprises (SMEs) and other businesses in the ecosystem to take advantage of facility to improve the quality of health care in the country.

“SMEs in Ghana have got a lot of challenges and banks do not go in for the health SMEs or grant loans to them but with this initiative, they will get loans to provide quality health care,” he added.

Dr. Maxwell Antwi, Country Director, PharmAccess, a sister organisation of MCF, reiterated that PharmAccess would continue to provide access to financing for medical quality improvement to health SMEs in the healthcare sector value chain.

GNA